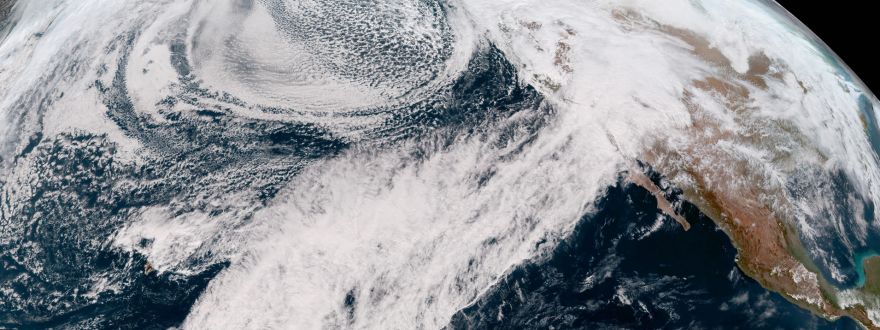

Wind has no season. It's a relentless force of nature, through hot, dry seasons, and wet, chilly storm systems alike. Wind also gets a lot less time in the spotlight than fires and floods. But fear not, we're here to make sure wind events get their fair share of the spotlight.

Last weeks' wind event and accompanying atmospheric river blew quite a few urgent inquiries into the Barber Insurance virtual office. Here are some helpful tips if your home has been damaged.

- Start by doing whatever you can to protect your roof or structure from further damage. Depending on the severity of the damage, this may mean tarping or tying down your roof, or hiring a professional to triage the situation until you can get an assessment of the damage for repair and a possible claim. Make sure everything affected is secure enough to prevent injury or disaster to you or anyone around you or cause further harm to your home..

- If it's an emergency or a threat to the safety of you or passerbys call 911.

- Save your receipts! Direct, sudden and accidental wind damage is generally covered by home insurance, so while we aren't able to confirm or deny coverage from our office, in our experience, many out of pocket expenses during this process may be reimbursed, less your deductible.

- Take a few photos. If the situation calls for you to pay for work to prevent further damage, and you haven't been able to confirm coverage, it is helpful for the adjuster to see the before and after to determine if there is coverage.

- Don't expect wear and tear to be covered. Every season, we get at least one or two calls about leaky roofs, or leaning fences, and sometimes these claims are just not covered. While direct, sudden, and accidental wind damage may be covered, maintenance is not. Rotting wood, and other telltale signs will be evident, and as we all know, wind or not, an old roof will eventually leak.

- Call your repair person. Ultimately, you'll be in charge of finding a trusted repair person that is reasonably priced to do this work, so it doesn't hurt to get that ball rolling for an estimate, knowing they get busy this time of year. People sometimes think the company sends a repair person out, but in reality, the company has adjusters to assess coverage, and work with your chosen repair person on the payment for the covered repairs.

- Not sure who to call for the work? We get this question often, and we understand, not everyone knows a repair person. There are many avenues; Check with neighbors, relatives or friends. Park managers, or the Better Business Bureau. You can also look at NextDoor which is an online community for shared recommendations. Our own website has a Partners Page featuring some of our commercial clients who we have insured or who have worked in our community, but remember, it's ultimately your choice, so do a little inquiry to feel good about who you work with.